Projects

Agent-based model of labor migration July 2025

Simulate labor migration from Turkey to Germany

This project [project website] aims to develop an agent-based model (ABM) to observe how complex, macro-level migration phenomena emerge from micro-level interactions between individuals within broader social and economic systems. A key goal is to study the counterfactual effects of migration policies (e.g., what if the Blue Card was never introduced or future policies become more restrictive). By documenting the modeling process, the project seeks to provide a practical guide for researchers and enhance the understanding of migration dynamics through computational simulations. Ultimately, the project aspires to inform policy decisions by revealing insights into how individual decisions aggregate into larger migration patterns.

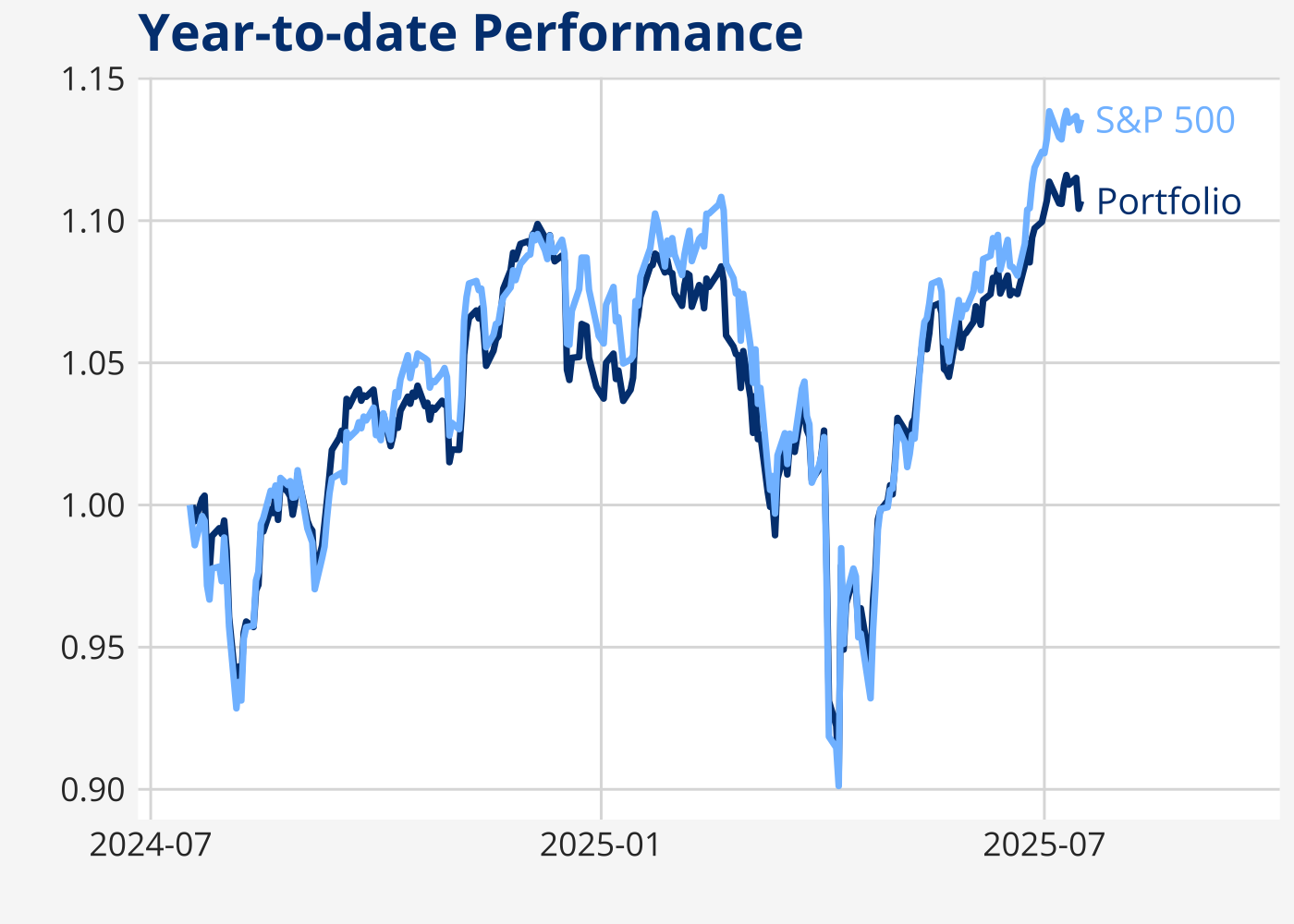

Portfolio Analysis June 2025

Investment tracker that analyzes portfolio performance, risk, and suggests optimal rebalancing across accounts

The application automatically calculates portfolio metrics across multiple accounts including beta, Value at Risk, and diversification scores using the Effective Number of Bets methodology. It tracks performance against the S&P 500, identifies optimal rebalancing opportunities based on target sector allocations, and generates reports with tax analysis including cost basis calculations and loss harvesting recommendations. The example is made from random trading data and code is not yet public.

Links: Example of Portfolio Analysis

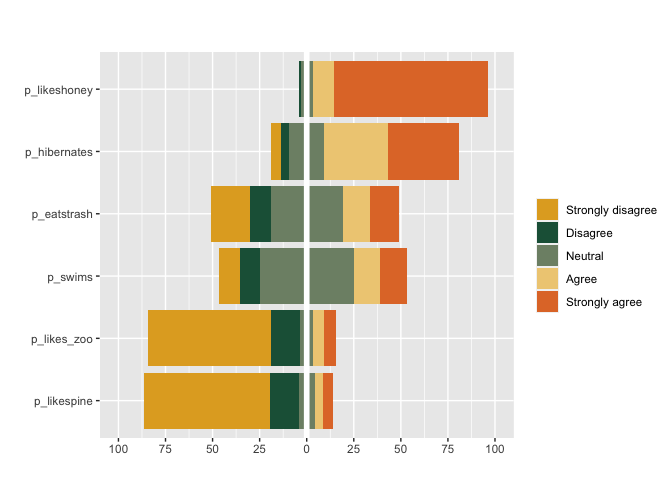

Surveyexplorer December 2023

A R package to Quickly Explore Complex Survey Data

surveyexplorer is an R package to visualize and tabulate single-choice, multiple-choice,

matrix-style questions from survey data. It includes ability to group cross tabulations,

frequency distributions, and plots by categorical variables and to integrate survey weights.

It’s ideal for quickly uncovering descriptive patterns in survey data.

Links: CRAN Documentation, Github

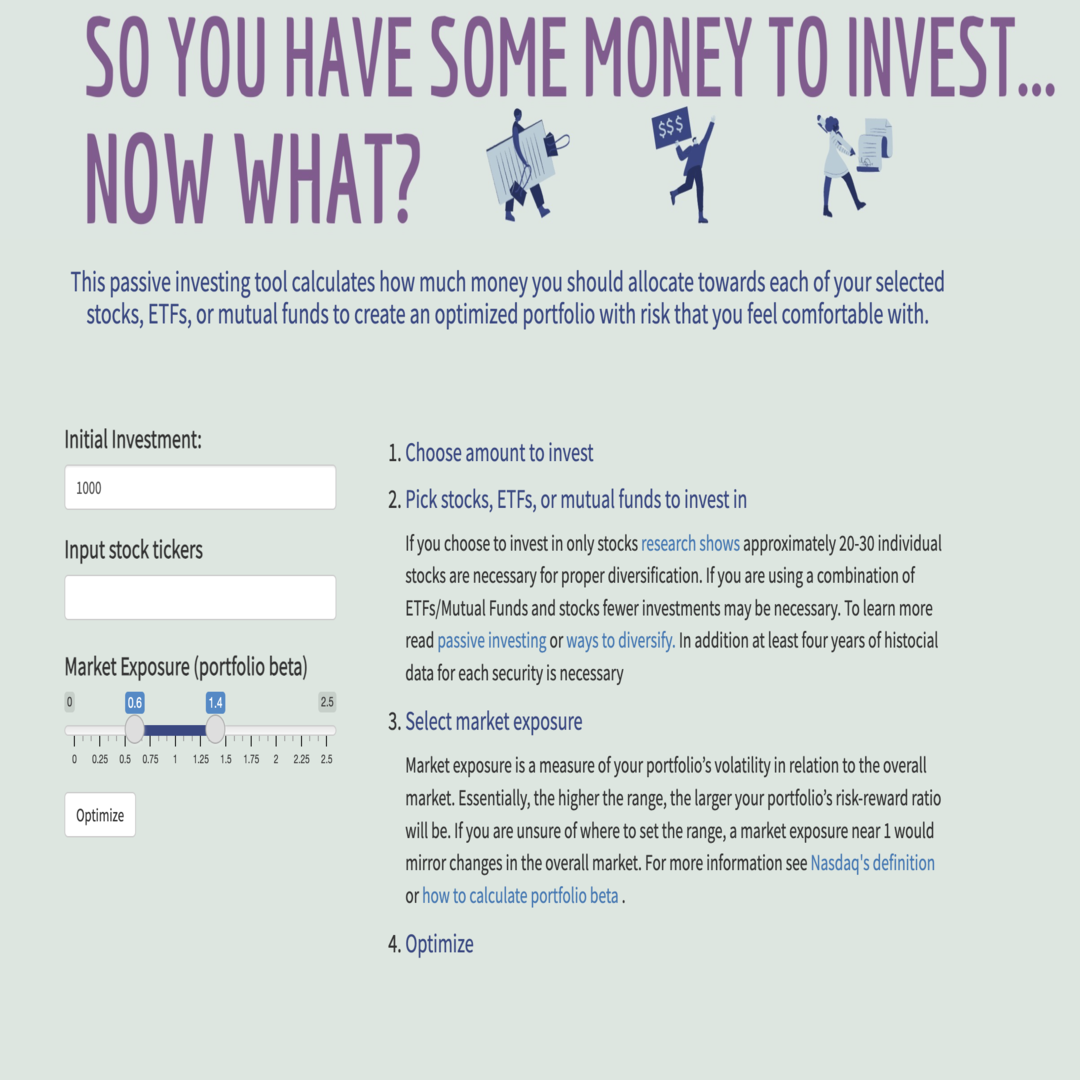

Money to Invest March 2020

Calculate optimal asset allocation for any given stocks, ETFs, mutual funds with an interactive shiny app

After taking some coursework in portfolio theory I was inspired to design an interface to more easily interact with the material. The shiny application allows users to select the amount amount they want to invest, which stocks, exchanges, or funds they’re interested in and the risk level of the portfolio measured by its beta. It then computes an optimal allocation with the additional constraint of no short selling.